![]()

IV-TRS Trading was established by Bruce Marshall to create an understanding of Option Trading in the Capital Markets. Mr. Marshall’s interest in the stock market started in the 1960’s as a young man investigating and reviewing generational family stock positions with bank trust officers. He devoted an extensive amount of personal capital to acquiring stocks at the inception of the 2000 “Dot-Com” bust. This activity turned out to be a great place to learn but a most expensive capital market introduction and education.

His focus today in the stock market is to formulate and execute creative “Swing Trade” option strategies to address the unusual volatility in today’s extremely challenging stock market.

Mr. Marshall employs extensive “Technical Analysis” in his stock trading techniques. He is a large proponent of the continued study and review of “Japanese Candlesticks”.

Japanese Candlesticks” were originally developed in the 18th century by Munehisa Homma, a Japanese Rice Trader. During routine rice trading, Homma discovered that the rice market was influenced by the emotions of traders while still acknowledging the effect of demand and supply in the price of rice. Originally a rice merchant from Sakata, Japan, Homma-san became an expert futures trader at the Dojima Rice Exchange in Osaka. Established in 1697, this exchange was the world’s first formal futures exchange. Although only physical rice was initially traded, in 1710 storage houses began issuing “empty rice coupons” for future delivery of rice…and with that futures trading was born. Homma-san was widely known trading success and was widely known as the “God of the Markets” by his fellow traders while accumulating a rumored net worth of $100 Billion in today’s U.S. Currency. He was eventually recruited as a financial advisor to Tokugawa Shogunate, the Japanese government at the time, and was awarded the tile of honorary Samurai.

Understanding and properly articulating market sentiments and fears is most important in successfully trading the divergent international investment markets.

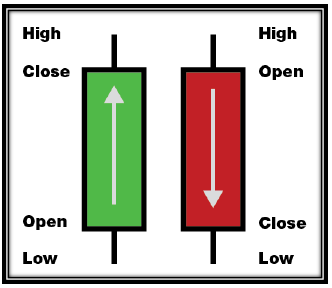

A “Candlestick” reflects four data points of information which include the open, high, low, and closing price of a stock.

The best way to understand them is by using a picture:

Patterns emerge in various time compressions and these lead to suggesting creative and often-times reasonably predictable stock movement that can often-times be quite financially rewarding.

There is an over-abundant amount of “noise” in the street when one watches today’s unusual stock volatility in the marketplace irrespective of one-time compression… be it for day traders, swing traders, intermediate and long-term investors.

Successful stock trading is achieved when a stock trader and/or investor can discerningly separate meaningless “market noise” and the misleading and often erroneous market chatter of the traditional TV “stock pundits” from clear and distinctive emerging stock movement trends.

Technical trading is helpful in this endeavor and summarily suggests that it is not in fact a “Random Walk Down Wallstreet” when one conscientiously addresses stock price movement.

rame src="https://player.vimeo.com/video/1066399329" width="481" height="361" frameborder="0" allow="autoplay; fullscreen" allowfullscreen>

V